TotalEnergies, pioneers for a Hundred Years

TotalEnergies, pioneers for a Hundred Years

Discover the history of our Company through a selection of key dates, and relive one hundred years of pioneering spirit and constant adaptation to the energy challenges of the 20th and 21st centuries. A journey through time and around the world!

1924-1945

1924

On the initiative of the French government, the Compagnie française des pétroles (CFP), a private company, was created to develop a national oil policy. The CFP was founded on the initiative of French Prime Minister Raymond Poincaré, who wrote the mission statement for Ernest Mercier, a graduate of the French Polytechnique engineering school with specialist expertise in the oil industry. He would be the first chairman of the company. CFP acquired 25% of the Turkish Petroleum Company, a share that had belonged to the Germans before the First World War. This brought CFP into the circle of European oil companies, such as the Compagnie Financière Belge des Pétroles created in 1920 (later Petrofina). And thus was laid the foundation of what would later become TotalEnergies.

CFP mission order, addressed by French Prime Minister Raymond Poincaré, to Ernest Mercier, 20 September 1923

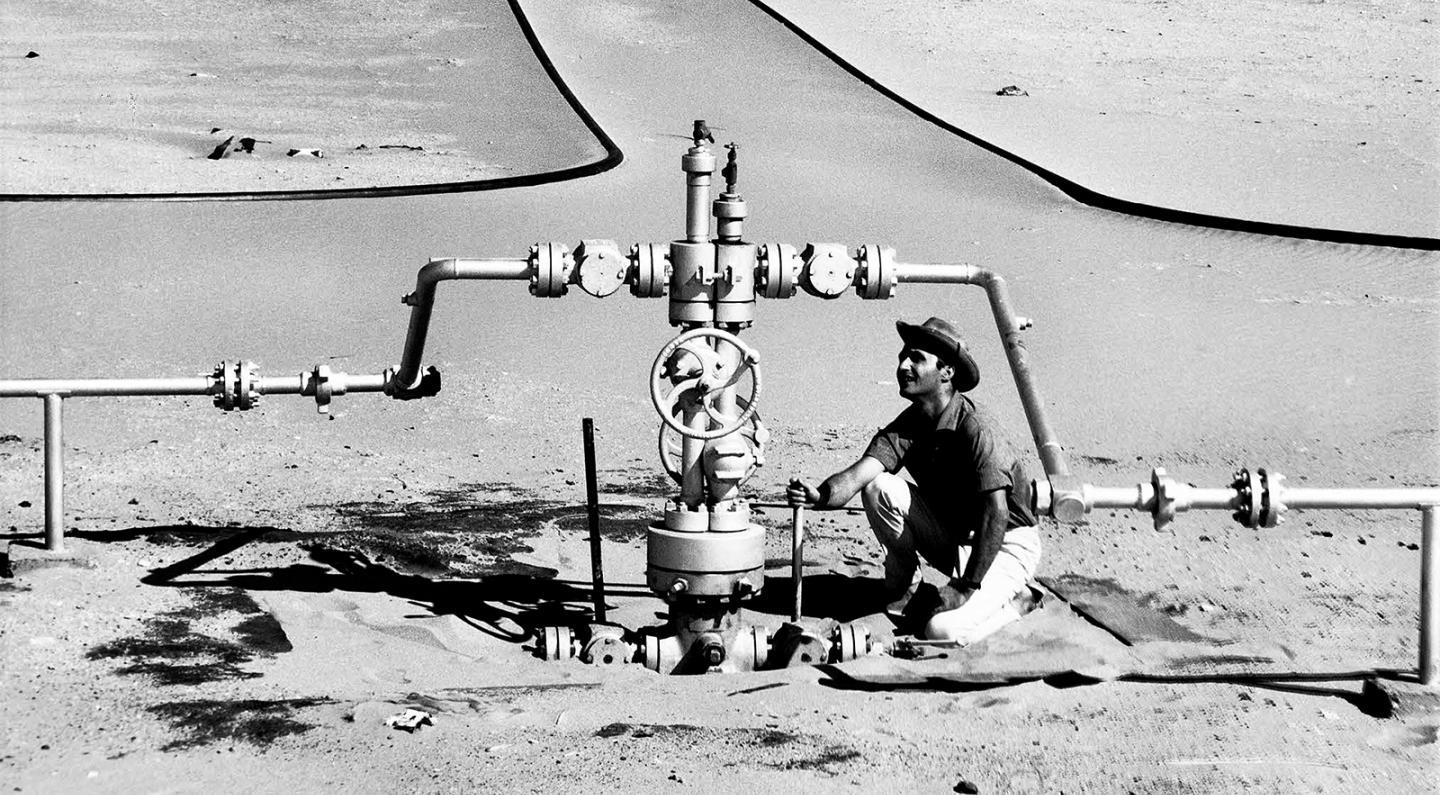

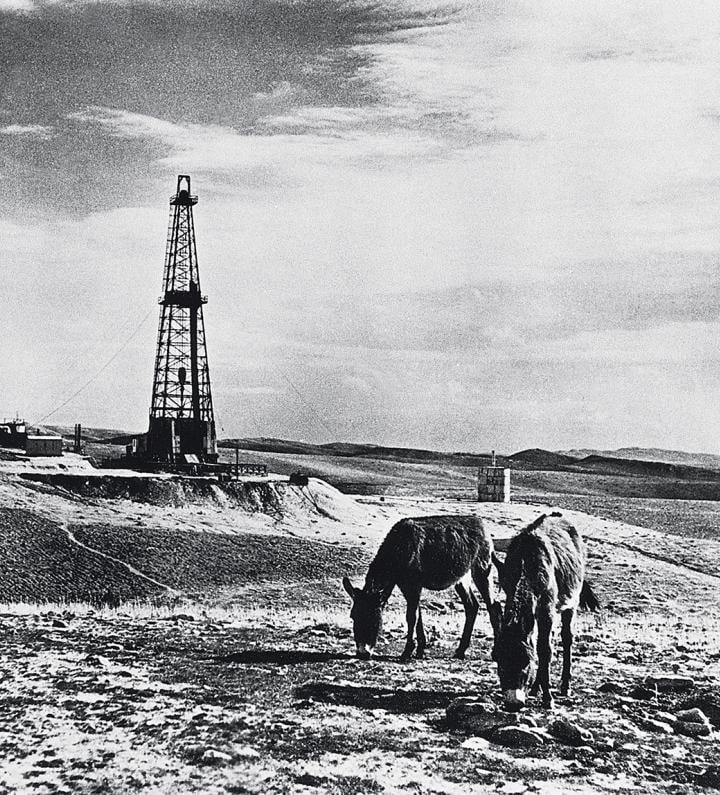

1927

First discovery of oil in the desert of Mesopotamia, today known as Iraq. Exploration and drilling campaigns by the Turkish Petroleum Company (which became Iraq Petroleum Company in 1928), involving seven French geologists from the Compagnie française des pétroles, made it possible to identify that first deposit 450 meters underground. On October 15, 1927, at an exploratory drilling site in Baba Gurgur, near Kirkuk, the pressure was such that oil gushed out of the ground to a height of more than 15 meters. It took eight days and a team of 700 men to get the flow under control. That discovery was the beginning of the TotalEnergies adventure in the Middle East.

Picture caption: Drilling derrick, Baba Gurgur, Iraq, 1927

1929

Shares in the Compagnie française des pétroles (CFP) were listed on the Paris stock exchange, opening up the company's capital to private investors and giving it the means to scale up. Faced with fierce competition and the need to invest massively in Iraq, CFP also made the decision that same year to secure State support by signing an agreement with the French government granting it a 25% stake in CFP. With that IPO, the company took its first step onto the financial markets. That move was completed in 1991 when shares in Total were listed on the New York Stock Exchange, increasing the proportion of international investors from 20% to 40%.

1933

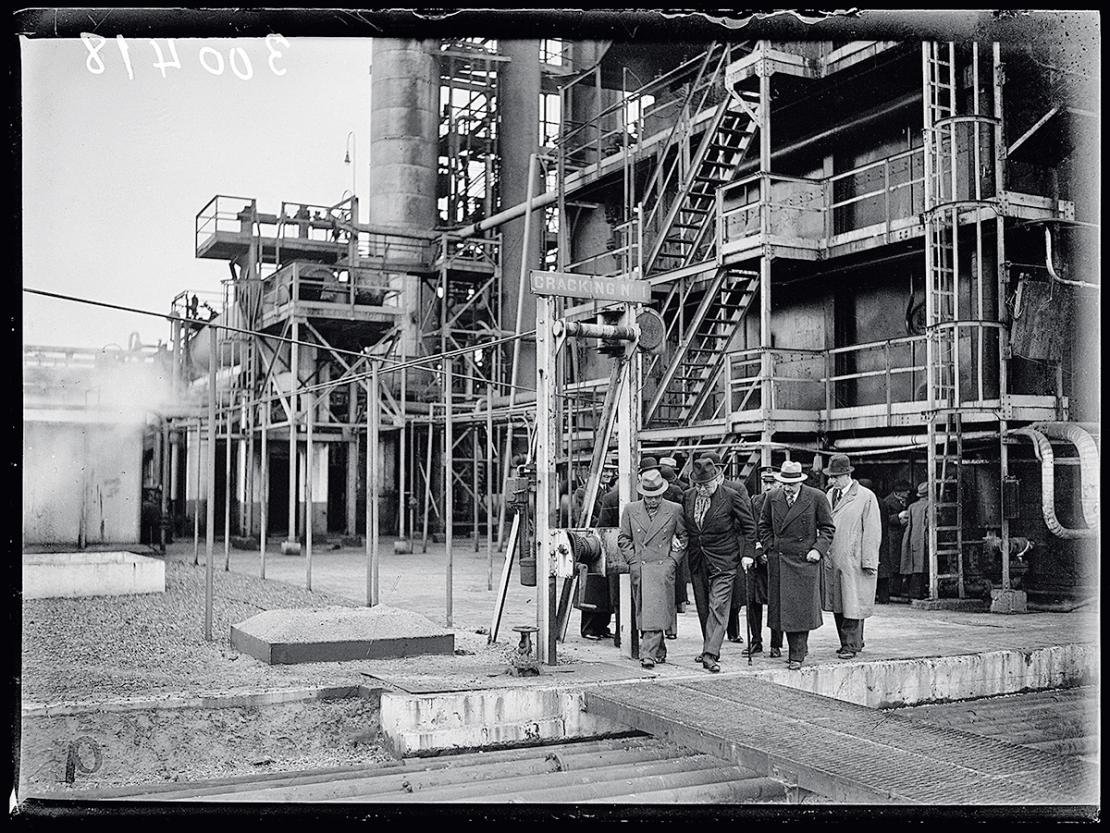

The Gonfreville refinery in Normandy was brought into service by the Compagnie française de raffinage (CFR). Two years later, another refinery would enter into service at La Mède, in the Provence region of France. Those large, modern facilities were added to the 12 refineries already up and running in France, but were the first ones not operated by foreign companies. CFR was created in 1929 to enable the Compagnie française des pétroles to expand downstream. It brought together new areas of expertise, enabling the Group to sell oil extracted in the Middle East and supply the French market. By the late 1950s, those two refineries were delivering 8 million metric tons of petroleum products annually, establishing CFR as a major player in the industry. The passing of that threshold also marked a turning point for TotalEnergies.

Anatole de Monzie, Minister of Public Works, visits the Gonfreville oil refinery, France, 1939

1939

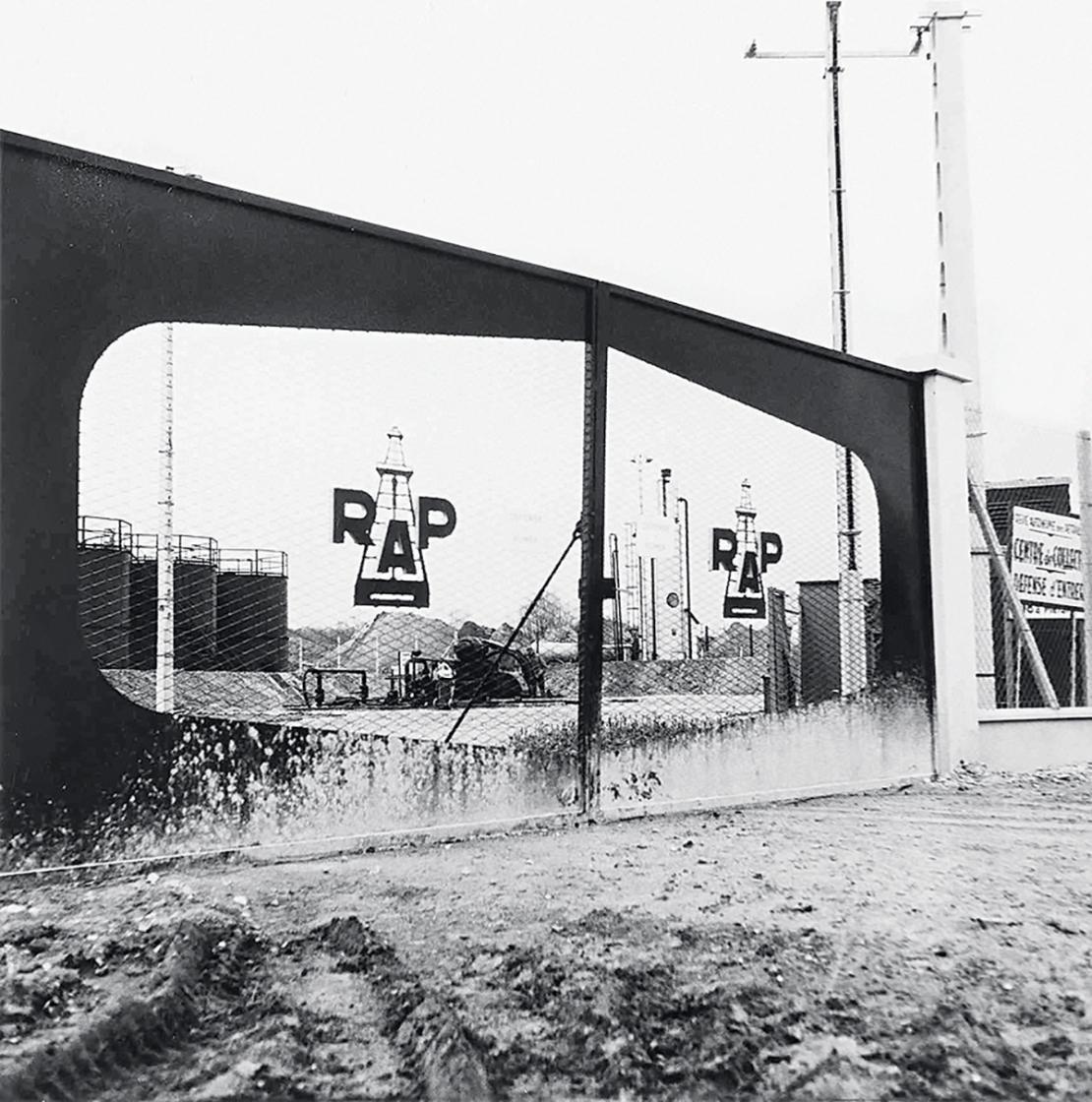

First discovery of a hydrocarbon deposit in France at Saint-Marcet in Haute-Garonne. Seven billion cubic meters of natural gas were found at a depth of 1,600 meters after extensive exploratory drilling in the Landes and Pyrénées-Atlantiques regions by the Centre de recherches de pétrole du Midi, founded in 1936. Extraction of the natural gas began in 1942. But that process would not reach an industrial scale until the end of the war, and it was only in 1949 that its production met the energy needs of a large part of south-western France. That discovery led to the founding of a new company, Régie autonome des pétroles (RAP), which was created to prospect for further deposits. That was the starting point for the future Elf group, which later became part of TotalEnergies.

Saint-Marcet production site, RAP collection facility, France, 1940

1939-1945

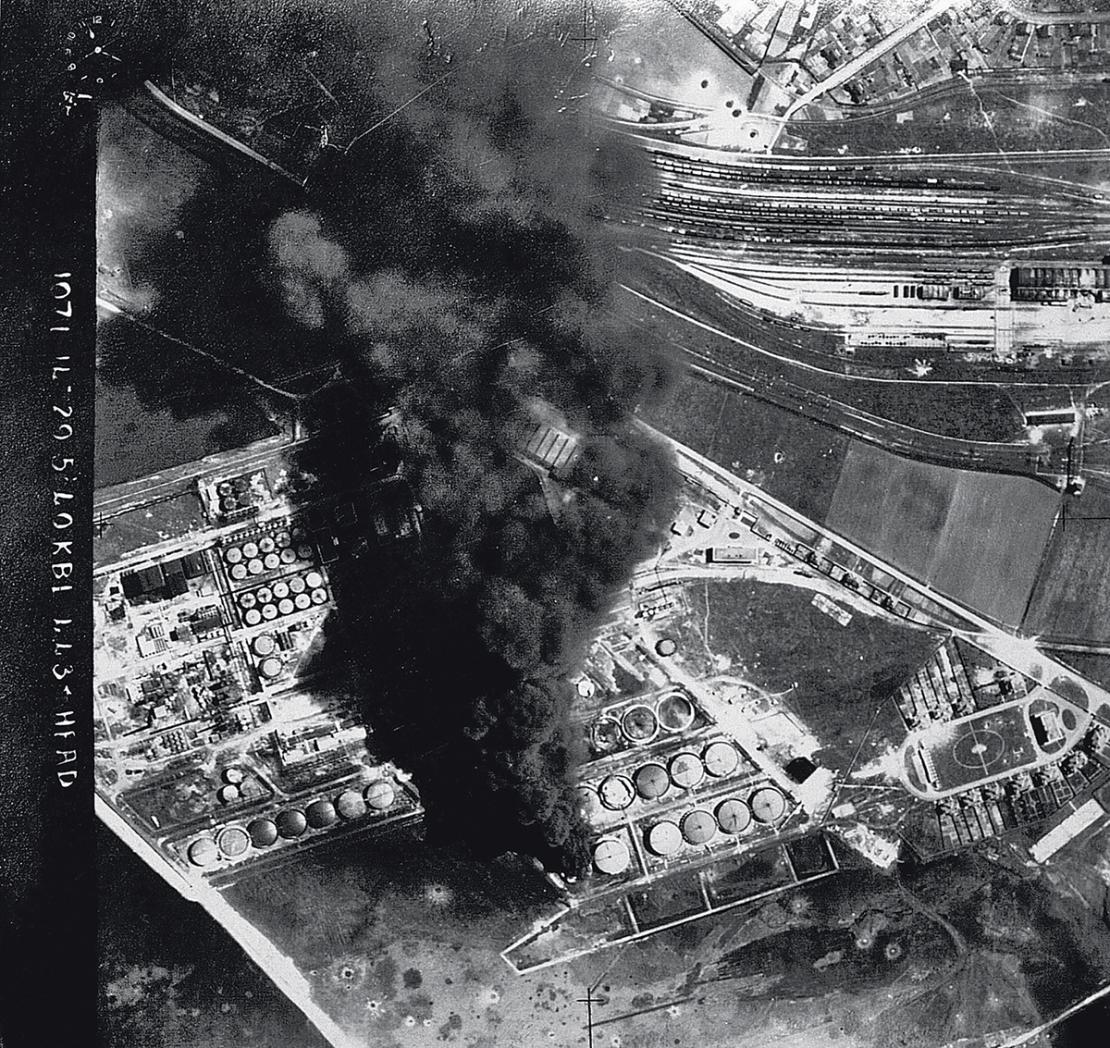

The strategic importance of oil became all the more evident during the Second World War, bringing lasting upheaval to the entire industry and the infrastructure put in place to support it. In 1939, the operations of the Compagnie française des pétroles (CFP) were disrupted when many of its employees were mobilized for the war. Considerable material damage was inflicted during the war, including the destruction of ships, stockpiles, and refineries. The CFP was forced to give ground several times before joining the Vichy regime in July 1940. After the armistice, CFP and the Belgian company Petrofina had to fight, sometimes in vain, to retain control of their assets and safeguard their interests. Faced with shortages, alternative fuels were produced, and a new company called Société nationale des pétroles d'Aquitaine—the cornerstone of what went on to become the Elf group—was created in 1941 to search for hydrocarbons in southwestern France.

Aerial view of the Dunkirk refinery and its burning oil tanks, France, 1940

1946-1970

1951

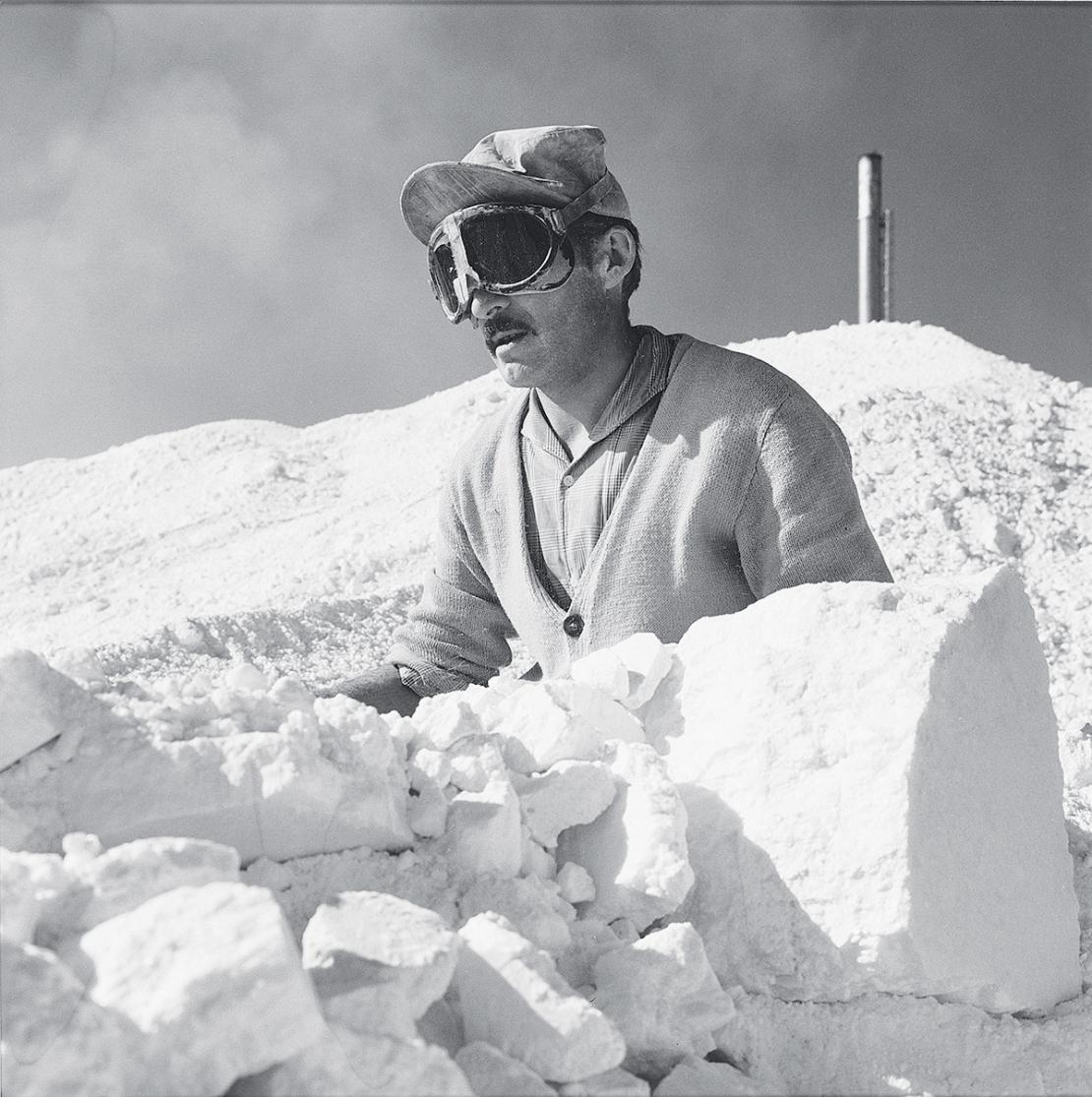

Discovery of a vast deposit estimated at over 200 billion cubic meters of natural gas by the Société nationale des pétroles d'Aquitaine (SNPA) 3,450 meters underground at Lacq, in the Béarn region of France. The deposit was unusual in every way: very high pressure and temperature at the bottom, as well as high proportions of carbon dioxide and hydrogen sulfide. But the estimated reserves were so great that SNPA decided to take up the challenge with the invaluable help of the French steel industry, which developed new types of steel specifically for the project! Extraction of the natural gas began in 1957. A nationwide network was rolled out, and this "French Texas" phenomenon went on to have a lasting impact on the entire French economic and energy ecosystem, as well as being a technological showcase for the future Elf group.

Worker loading solidified sulphur, Lacq plant, France, 1959

1954

Creation of the new Total brand and logo by the Compagnie française des pétroles and the Compagnie française de raffinage with a view to creating a distribution network to enable growth further down the oil industry value chain. The name was chosen because it was simple, easy to remember and pronounce, and could be used anywhere in the world, which hinted at the Group's intention to expand internationally. Independent distributors were bought out or became partners before developing their own network. In 1958, Belgium's Petrofina also changed its Purfina brand, created in 1920, and became the more international Fina. Multiple brands (La Mure, Avia, Caltex, etc.) from the ERAP group (merger of RAP, SNPA, and BRP) were united under the Elf brand in 1967, during the famous "Night of the red circles". And thus was laid the foundation of TotalEnergies' historic brands.

1969

Acquisition by the Compagnie française des pétroles of 50% of Japanese company Japex's rights in two licenses held in Indonesia's Mahakam delta, east of the island of Borneo. That made the Group the operator of the deposits and was one of the first production sharing contracts signed with the Indonesian government. Substantial oil and gas reserves were discovered at Handil and Bekapai in the early 1970s, making Total Indonesia the second-largest international oil player in the country, which had long been the exclusive stronghold of American companies. The subsidiary's gas production supplied the Bontang liquefaction plant on a massive scale, and Indonesian LNG came to play a major role in the industry. It also secured the position of TotalEnergies going forward in that key part of the world.

Commissioning of the Bontang unit, Indonesia, 1977

1970

The Compagnie française des pétroles and the Entreprise de recherches et d'activités pétrolières (ERAP) took over Antar (24% and 41% stakes respectively), a company that had run into financial difficulties. A specialist in lubricants and motor oils, Antar operated several refineries in France and had its own network of 5,670 service stations. In the 1970s, the restructuring of the public oil sector intensified: ERAP and Société nationale des pétroles d'Aquitaine (SNPA) merged in 1976 to create Elf Aquitaine, a new national champion. The new group finally took full control of Antar that same year, a major turning point for its distribution business, as the takeover enabled it to double the number of its service stations in France to the critical size of 10,000.

1971-1997

1971

Off the coast of Norway, extraction of the oil (over 3 billion barrels) and gas (180 billion cubic meters) deposits that make up the "Great Ekofisk" began. Another huge natural gas deposit—200 billion cubic meters—was also discovered at Frigg, followed by another natural gas and oil field at Alwyn in 1975. The companies that would later go on to become TotalEnergies (Compagnie française des pétroles, Petrofina, and Elf-ERAP), operators and partners in those fields, were working together in the North Sea. Highly specialized, risky, and costly, extraction of the hydrocarbons from those deposits played an important role in diversifying sources outside the Middle East, especially after the 1973 oil crisis. Natural gas was increasingly becoming an alternative fuel to oil and was coming to occupy a more important place in the business portfolio of the future TotalEnergies.

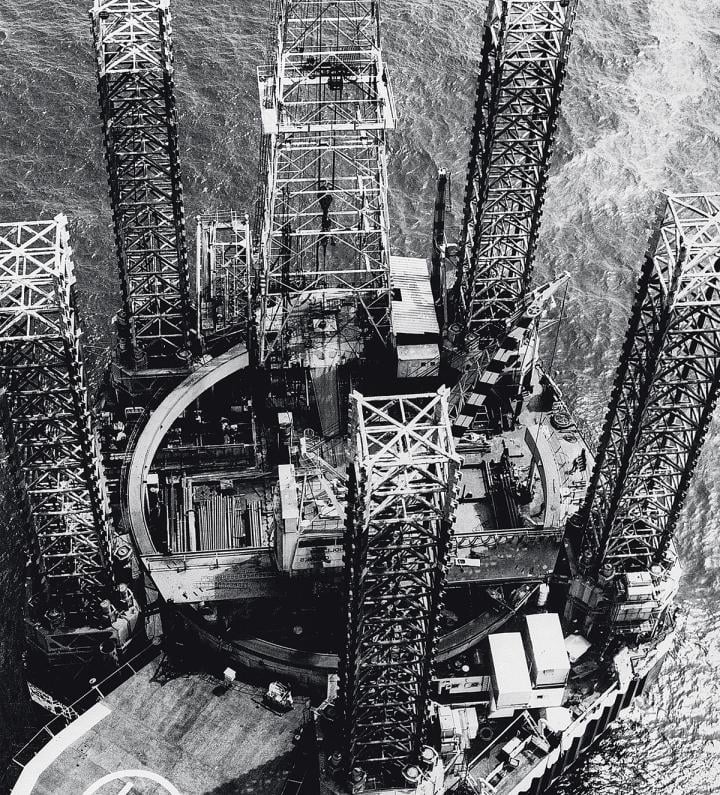

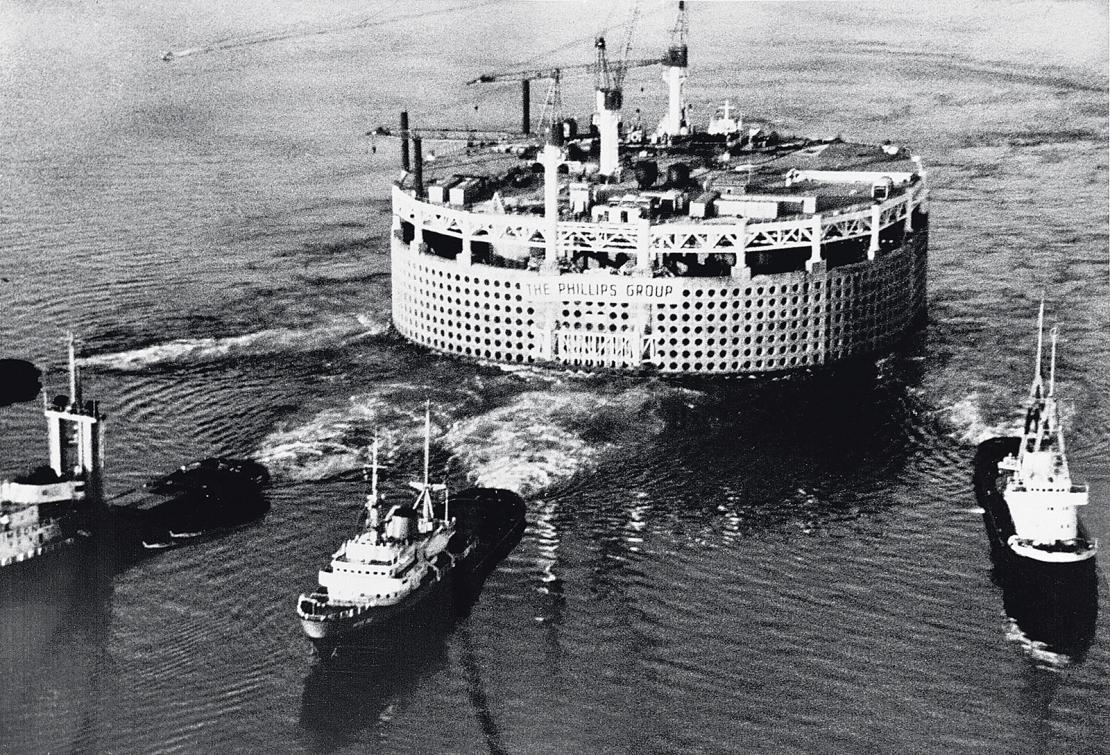

Transporting the Ekofisk storage tank, North Sea, 1971

1974

The Compagnie française des pétroles took control of Hutchinson, a long-established French company founded in 1853 and a world leader in rubber processing. Fine or specialty chemicals became a necessary diversification for oil companies, due to the rise in prices following the 1973 oil crisis. It was not until 1991 that Total launched a takeover bid to acquire the 16.2% of Hutchinson's capital that the Group did not yet own.

Advertisement for Hutchinson tyres, 1910

1982

A new world record for the Compagnie française des pétroles (CFP) with the drilling of a deepwater well to a depth of 1,714 meters, 100 km off the Rhone delta. The first deepwater drilling project ever undertaken in the oil industry, it was made possible by Creusot-Loire's invention of a special riser (the pipe linking the seabed to the oil rig on the surface), designed in collaboration with Elf and the French Petroleum Institute. That operation in the Mediterranean was part of the exploration of new fields outside the Middle East, which had become a strategic priority since the oil crisis in 1973. The techniques used to make that record-breaking operation possible were a first step towards deep offshore drilling, a specialty in which TotalEnergies would become a major player from the late 1990s.

Drillship, Discoverer Seven Seas, 1986

1989

Elf and Total launched the Optane and Total Premier unleaded fuels to meet new environmental standards in refining. The group's industrial facilities were also evolving to adapt to the production of diesel, which was increasingly used to fuel cars. Innovations of that sort were made possible by the strong emphasis placed on research by TotalEnergies and its member companies. Indeed, the Compagnie française des pétroles opened its first research laboratory in Paris in 1931, and subsequently set up dedicated companies with other industrial players (fuel processing for synthetic gasoline, bitumen production, etc.). In the 1950s, the Compagnie française de raffinage had set up a research center in Gonfreville.

OPTANE, Elf poster, Super unleaded, 1990

1996

Elf Aquitaine discovered one of the world's largest offshore oil deposits at a depth of more than 1,300 meters at Block 17, a zone covering some 4,000 km2 about 150 km off the coast of Angola. Girassol was a decisive new step in the development of deep offshore hydrocarbon extraction operations. Major technical innovations were implemented, such as the FPSO system (floating production, storage, and offloading unit), a fully autonomous vessel that combines the production/storage and loading functions at sea with those of an oil tanker. The incredible adventure in the Block 17 zone continued with other, often giant, deposits discovered and tapped in the 2000s and 2010s (Dalia, Rosa, Pazflor, Clov). At that point, the company had gained an undeniable technological edge.

Girassol FPSO, 2001

1998-2004

2000

After Petrofina in 1999, Total acquired Elf Aquitaine and the TotalFinaElf group came into being. The first merger enabled the TotalFina group to reach a size equivalent to that of Elf Aquitaine; the second gave rise to a French champion able to compete with the American and British oil giants at a time when the oil sector was being restructured on a global scale. With over 132,000 employees, a turnover of €114 billion, and production of 2.1 million barrels per day, TotalFinaElf became the world's fourth-largest hydrocarbon producer. With 17,500 service stations worldwide and a refining capacity of 2.6 million barrels a day, it also became Europe's number-one downstream operator. And the new group was the world's fifth-largest producer of chemicals. In 2003, TotalFinaElf shortened its name to simply Total, marking the end of the merger process.

Thierry Desmarest, Chairman and CEO of TotalFina, at the TotalFinaElf annual general meeting France, 2000

2004

A restructuring of its chemicals business with a renewed focus on petrochemicals led Total to set up a new company called Arkema. Arkema took over the intermediate activities, high-performance polymers, and chlorochemicals business lines. In 2006, Arkema was listed on the French stock exchange as part of a spin-off. At the same time, the Group was strengthening its petrochemicals business (polystyrene, polypropylene, etc.), which was closely integrated with refining and grouped together within Total Petrochemicals: production capacities at the sites were increased and a company was being set up in Asia—a very buoyant market—in partnership with Korea's Samsung General Chemicals. Downstream specialty chemicals were reorganized into decentralized structures: Bostik (adhesives), Hutchinson (rubber), Atotech (electroplating), Cray Valley (resins). The paint, bromine, and derivatives businesses were sold.

2005-2024

2011

Total took a 60% stake in Sunpower, America's second-largest manufacturer of solar panels. The company also got involved downstream in the development, construction, and operation of large-scale solar farms. That acquisition was just one of a series of investments in solar energy and technologies, which had begun with the creation of the solar panel manufacturing company Total Energie back in 1983. The company also acquired stakes in several start-ups specializing in biomass recovery and the development of bioplastics. With this strategy, the company was looking to diversify into new resources. But the real turning point came about in 2015, with the drive to offer a new energy mix with steadily decreasing carbon intensity.

Cleaning the solar panels at the Nanao solar power plant, Japan, 2017

2013

Jubail in Saudi Arabia became Total's 6th integrated oil platform, along with the ones in Normandy in France, Port Arthur in the United States, Daesan in South Korea, Ras Laffan in Qatar, and Antwerp in Belgium. Those sites—located in strategic markets—combined the refining and petrochemicals business lines in a logical industrial approach (obvious links between the two activities), and in response to efficiency and profitability challenges: optimization of flows in mature markets (Europe), development of integrated offerings in growth markets (Middle East and Asia), economies of scale, development of synergies. That strategy was essential to keep the group competitive and adapt to major changes in the global marketplace.

Jubail refinery, Saudi Arabia, 2013

2016

Total acquired Saft Groupe, the world leader in the design and production of high-tech batteries for industry. With that acquisition, the group added electricity storage solutions to its portfolio, an essential complement to the development of renewable energies. The same year saw the creation of a new Gas, Renewables & Power division, designed to support the company's ambitions in the electricity sector, notably through the development of downstream gas and renewable energies. The way things were headed was clear: electricity would be the energy of the 21st century, and the group was giving itself the means to pursue that goal: further acquisitions put it in a position to accelerate its growth in that energy of the future.

Saft batteries at the Bordeaux site, France, 2022

2017

Total took a 23% stake in Eren Renewable Energy, a French company specializing in solar, wind, and hydro power, with 650 megawatts of installed capacity worldwide. That acquisition put the group in a position to step up its development in renewable energies and enter the wind power sector. Renamed Total Eren, it became a wholly-owned subsidiary of Total in 2023, with 3.5 GW of assets in operation worldwide and 10 GW in its portfolio.

Patrick Pouyanné with Pâris Mouratoglou (right), Chairman of Eren Renewable Energy, and David Corchia (left), CEO, pictured as Total acquires stakes in Eren Renewable Energy, France, 2017.

2020

Total announced its intention to achieve, together with society at large, carbon neutrality by 2050 for all its global activities, from production to the use of energy products by customers. That ambition is reflected in the stepping up of investments in green electricity and decarbonated molecules: in Qatar (construction of its first solar power plant); in Spain and the United States (solar projects, notably in partnership with South Korean company Hanwha); in the North Sea (the group became the majority shareholder in the giant Seagreen 1 offshore project, designed to supply two-thirds of Scotland's homes with green energy); or in France (the Grandpuits refinery is being converted into a "zero oil" platform specializing in the production of biofuels and bioplastics).

Cover of the Climate report "Towards Carbon Neutrality", 2020

And the story goes on!

Learn more